JINHUA, CHINA-- (March 16, 2018) - Kandi Technologies Group, Inc. (the “Company,” “we” or “Kandi”) (NASDAQ GS: KNDI), today announced its financial results for the full year ended December 31, 2017.

Full Year 2017 Highlights

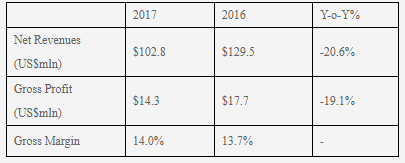

•Total revenues were $102.8 million in 2017, a decrease of 20.6% from total revenues of $129.5 million in 2016.

•EV parts sales decreased by 18.9% to $97.4 million in 2017, compared with EV parts sales of $120.1 million in 2016.

•Off-road vehicles sales decreased by 4.3% to $5.4 million in 2017, compared with off-road vehicles sales of $5.7 million in 2016.

•Kandi Electric Vehicles Group Co., Ltd. (The “JV Company”) sold 11,437 EV products in 2017, compared to 10,148 EV products sold in 2016, an increase of 12.7%.

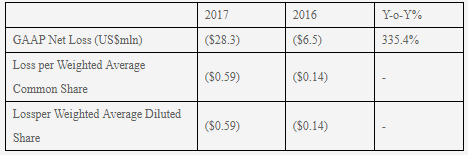

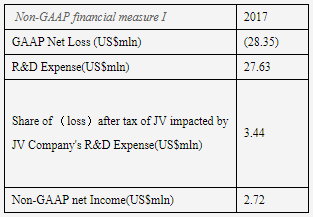

•GAAP net loss in 2017 was $28.3 million, or $0.59 loss per fully diluted share, compared with GAAP net lossof $6.5 million, or $0.14 loss per fully diluted sharein 2016.The primary reason for the GAAP net loss in 2017 was due to $27.6 million research & development (“R&D”) expenses in 2017 related to the development of K23 and other models; additionally, the JV Company incurred R&D expenses of $6.88 million (which posed $3.44 million impact on Kandi’s net loss). Excluding the impact from the R&D expenses, under the Non-GAAP adjusted financial measure I, our net income[1] for 2017 would be $2.72 million, or $0.06 earnings per fully diluted share.

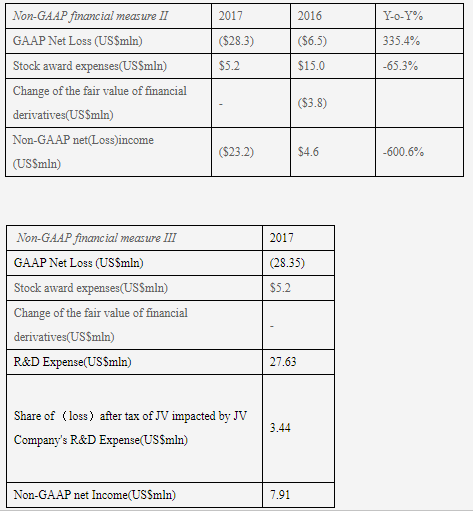

•Non-GAAP adjusted financial measure II[2], which excludes stock award expenses and changes in the fair value of financial derivatives, was net loss of $23.2 million in 2017, compared with non-GAAP adjusted net income of $4.6 million in 2016. Non-GAAP adjusted loss per share1 was approximately $0.48 per fully diluted share for the full year of 2017, compared with non-GAAP adjusted earnings per share of $0.10 per fully diluted share for the full year of 2016.Excluding the impact from the R&D expenses, under the adjusted Non-GAAP financial measure III[3], our net income for 2017 was $7.9 million, or $0.17 earnings per fully diluted share.

•Working capital surplus was $53.7 million as of December 31, 2017. Cash, cash equivalents and restricted cash totaled $16.1 million as of December 31, 2017.

Mr. Hu Xiaoming, Chairman and Chief Executive Officer of Kandi, commented, “2017 was still a challenging year for Kandi. Our business had been heavily impacted from the confusion surroundingthe reusable battery exchange model, however Kandi has been working diligently to overcome the difficult time and resolve the issues. We are confident to successfully execute our long-term business model in the renewable energy industry that is full of opportunities in the future, and hopping to be back in the major league among EV industry players.”

“Although, the EV unit sales in 2017 did not meet the expectations, the Company has had modest progress in the product R&D. To name a few, the pure electric SUV model K26 has been upgraded to be EX3, which will be exhibited at the upcoming launch event in March 26, where there will be more than 100 distributors and over 10 media representatives attending. Furthermore, Hainan facility’s model K23 production will commence in March 28. We believe these new products will strengthen our company’s competitiveness as well grow our market share. In my personal view, the loss in 2017 was temporary and strategic. What we have done in the past year will lay a strong foundation to prepare for the future development. Being the frontrunner in the pure EV industry, we are not only the pure EV products manufacturer but also an advocate of urban car-share with significant influence in the development of China’s urban travel ecosphere. Whether the business model or the market share, Kandi is packed with solid fundamentals exceling its peers. The management team is confident in our future growth.” Mr. Hu concluded.

Full Year 2017 Financial Results

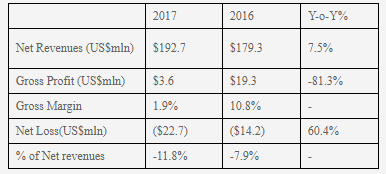

Net Revenues and Gross Profit

Net revenues for the full year 2017 decreased 20.6% from 2016. The decrease in net revenues was mainly due to the decrease of sales volume. Gross margin for the full year 2017 increased to 14.0%, compared with 13.7% in 2016. The moderate increase of gross margin was due to increased gross margin attributable to off-road vehicles sales in the year 2017.

Operating Income (Loss)

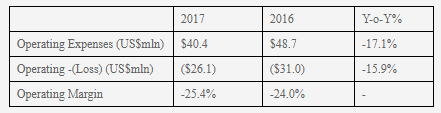

Total operating expenses in 2017 were $40.4 million, compared with $48.7 million in 2016. The decrease in total operating expenses was due to decreased general and administrative expensesin 2017.

GAAP Net Loss

Non-GAAP Financial Measures

We make reference to certain non-GAAP financial measures, i.e., adjusted net income. Management believes that such adjusted financial results are useful for investors in evaluating our operating performance because they present a meaningful measure of corporate performance. See the non-GAAP reconciliation table below. Any non-GAAP measures should not be considered as a substitute for, and should only be read in conjunction with, measures of financial performance prepared in accordance with the GAAP.

The following table summarizes our non-GAAP net income (loss):

Net loss in 2017 was $28.3 million, compared with net lossof $6.5 million in 2016. The increase in net loss was primarily attributable to $27.6 million related to the development of K23 and other models; additionally, the JV Company incurred R&D expenses of $6.88 million (which posed $3.44 million impact on Kandi’s net loss) .

JV Company Financial Results

In the full year 2017, the JV Company sold 11,437 EV products, a 12.7% increase from 2016. Total EV product sales comprised 7,416 units of Model K12, 3,939 units of Model K17 and 82 units of other models.

The condensed financial income statement of the JV Company for the full year 2017 is as set forth below:

Kandi’s investments in the JV Company are accounted for under the equity method of accounting, as Kandi has a 50% ownership interest in the JV Company. As a result, Kandi recorded 50% of the JV Company’s loss for $11.3 million for the full year 2017. After eliminating intra-entity profits and losses, Kandi’s share of the after tax loss of the JV Company was $11.6 million for the full year 2017.

Full Year 2017 Conference Call Details

The Company has scheduled a conference call and live webcast to discuss the financial results at 8:00 AM (U.S. Eastern Time) on March 16, 2017 (8:00 PM Beijing Time on March 16, 2017). Mr. Hu Xiaoming, the Company’s Chief Executive Officer and Mr. Mei Bing, the Company’s Chief Financial Officer, will deliver prepared remarks, followed by a question and answer session.

The dial-in details for the conference call are as follows:

•Toll-free dial-in number: +1-877-407-3982

•International dial-in number: + 1-201-493-6780

•Webcast and replay: http://public.viavid.com/index.php?id=128730

A live audio webcast of the call may also be accessed by visiting Kandi's Investor Relations website at http://www.kandivehicle.com. An archive of the webcast will be available on the Company's website following the live call.