-Q1 revenue increased 95.0% YoY to $8.3 million

-Q1 JV sold 3,295 EV products

-Q1 GAAP net income achieved $3.7 million, or $0.07 EPS compared to GAAP net loss of $24.2 million, or $0.51 loss per share

JINHUA, CHINA--(May 10,2018) - Kandi Technologies Group, Inc. (the “Company,” “we” or “Kandi”) (NASDAQ GS: KNDI), today announced its financial results for the first quarter of 2018.

First Quarter Highlights

Total revenues increased 95.0% to $8.3 million for the first quarter of 2018, from $4.3 million for the same period of 2017.

Electric Vehicle (“EV”) parts sales increased 139.1% to $6.4 million for the first quarter of 2018, compared with $2.7million in the same period of 2017.

Kandi Electric Vehicles Group Co., Ltd. (the “JV Company”) sold 3,295 EV products in the first quarter of 2018, compared to no EV products sold in the same period in 2017.

Off-road vehicle revenues increased 22.0% to $2.0 million for the first quarter of 2018 compared with $1.6 million in the same period of 2017.

GAAP net income for the first quarter of 2018 was $3.7 million, or $0.07 per fully diluted share, compared with net loss of $24.2 million, or $0.51 loss per fully diluted share in the same period of 2017.

Non-GAAP adjusted net loss[1], which excludes stock compensation expenses of $1.0 million net of a reversal for forfeited stock option of $2.6 million and the change in fair value of contingent consideration which was a gain of $2.7 million, was $0.6 million in the first quarter of 2018, compared with non-GAAP net loss of $21.7 million for the same period of 2017. Non-GAAP adjusted loss per share1 was approximately $0.01 per fully diluted share for the first quarter of 2018 compared with Non-GAAP adjusted loss per share1 of $0.45 per fully diluted share for the same quarter of 2017.

Working capital surplus was $50.1 million as of March 31, 2018.Cash, cash equivalents and restricted cash totaled $8.5 million as of March 31, 2018.

Mr. Hu Xiaoming, Chairman and Chief Executive Officer of Kandi, commented, “We have taken strides to accelerate our EV sales and we are very pleased with our strong performancegiven the first quarter being a slow season. In March, the JV Company unveiled its first all-electric SUV model Geely Global HawkEX3, although it is not yet in production, there has already been overwhelming requests from interested dealers. At the end of March, Kandi Model K23 production was launched and sales are expected to be advanced in the second half of 2018. We are confident in these new EV productsbecomingadriving force that will fuel the growthof Kandi’s EV business.”

“In the first quarter, we completed the acquisition of Jinhua An Kao Power Technology Co., Ltd. and have consolidated itsfinancial statements. An Kao’s unique system of pure electric car battery replacement technology is a major step forward to our existing EV offering. Theacquisition is expected to generate additional revenues and provide a considerably competitive advantage in product delivery and services that will lead to market share gain.Looking forward, we expect continued momentum of Kandi’s EV business to a new phase of growth in 2018.” Mr. Hu concluded.

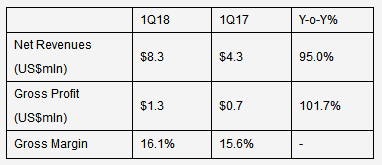

Net Revenues and Gross Profit

Net Revenues and Gross Profit

Net revenues for the first quarter increased 95.0%compared to the same period last year. The increase in revenue was mainly due to the increase in EV parts sales during this quarter.

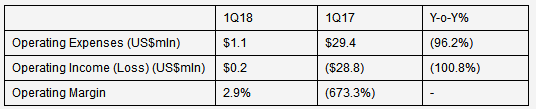

Operating Income (Loss)

Total operating expenses in the first quarter were $1.1 million, compared with $29.4 million in the same quarter of 2017. The decrease in total operating expenses was primarily due to decreased research and development, which was$0.8 million in this quarter, compared with $20.8 million in the same quarter last year.

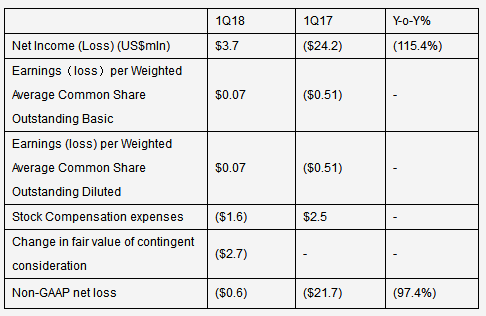

GAAP Net Income

Net income was $3.7 million in the first quarter, compared with net loss of $24.2 million in the same quarter of 2017. The increase was primarily attributable to increased sales and gross profits, increased profits from the JV Company and significantly decreased R&D expenses this period.

Non-GAAP net loss was $0.6million, a 97.4% decreased loss in the first quarter of 2018 compared to net loss of $21.7 million in the same quarter of 2017. The decrease in Non-GAAP net loss wasprimarily attributable to increased sales and gross profits, increased profits from the JV Company and significantly decreased R&D expenses this period.

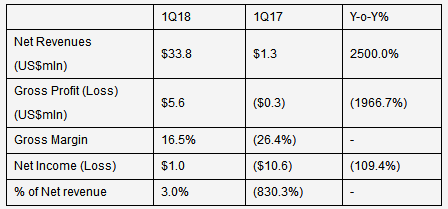

JV Company Financial Results

In the first quarter, the JV Company sold a total of 3,295 units of EV products, compared to no EV product sales in the same period of 2017.In this quarter, total revenue was $33.8 million as compared to $1.3 million for the quarter ended March 31, 2017.

The condensed financial income statement of the JV Company in the first quarter is as below:

Kandi’s investments in the JV Company are accounted for under the equity method of accounting, as Kandi has a 50% ownership interest in the JV Company. As a result, Kandi recorded 50% of the JV Company’s income for $0.5 million for this quarter. After eliminating intra-entity profits and losses, Kandi’s share of the after tax profit of the JV Company was $0.8 million for the first quarter of 2018.

First Quarter of 2018 Conference Call Details

The Company has scheduled a conference call and live webcast to discuss its financial results at 8:00 A.M. Eastern Time (8:00 P.M. Beijing Time) on May 10, 2018. Mr. Hu Xiaoming, Chief Executive Officer of the Company, and Mr. Mei Bing, Chief Financial Officer of the Company, will deliver prepared remarks to be followed by a question and answer session.

The dial-in details for the conference call are as follows:

· Toll-free dial-in number: +1-866-548-4713

· International dial-in number: +1-323-794-2093

· Webcast and replay: http://public.viavid.com/index.php?id=129741

The live audio webcast can also be accessed by visiting Kandi's Investor Relations page on the Company’s website athttp://www.kandivehicle.com. An archive of the webcast will be available on the Company’s website following the live call.

[1]Non-GAAP measures, including the Non-GAAP net income (loss) and Non-GAAP EPS are defined as the financial measures excluding the change of the fair value of contingent consideration and the effects of the stock compensation expense. We supply non-GAAP information because we believe it allows our investors to obtain a clearer understanding of our operations. Any non-GAAP measures should not be considered as a substitute for, and should only be read in conjunction with, measures of financial performance prepared in accordance with GAAP.