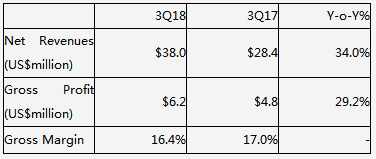

- Q3 revenue increased 34.0% yoy to $38.0 million –

- Q3 gross profit increased 29.2% yoy to $6.2 million–

JINHUA, CHINA-- (November 9, 2018) - Kandi Technologies Group, Inc. (the “Company,” “we” or “Kandi”) (NASDAQ GS: KNDI), today announced its financial results for the third quarter of 2018.

Third Quarter Financial Highlights

•Total revenues were $38.0 million for the third quarter of 2018, an increase of 34.0% from total revenues of $28.4 million for the same period in 2017.

•Electric Vehicle (“EV”) parts sales increased by 18.7%, to $32.1 million for the third quarter of 2018, compared with EV parts sales of $27.0 million for the same period in 2017.

•Gross profit increased by 29.2% to $6.2 million, compared to $4.8 million for the same period last year.

•Kandi Electric Vehicles Group Co., Ltd. (the "JV Company") sold 1,502 units of EV products in the third quarter of 2018.

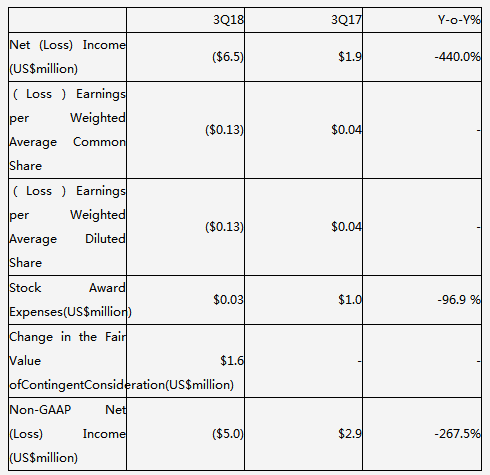

•GAAP net loss for the third quarter of 2018 was $6.5 million, or loss of $0.13 per fully diluted share compared with GAAP net income of $1.9 million, or income of $0.04 per fully diluted share for the same period in 2017.

•Non-GAAP adjusted net loss[footnoteRef:1], which excludes stock award expenses and the change of the fair value of contingent consideration, was $5.0 million in the third quarter of 2018, compared with non-GAAP net income of $2.9 million for the same period in 2017. Non-GAAP adjusted loss per share1 was approximately $0.10 per fully diluted share for the third quarter of 2018, compared with Non-GAAP adjusted income per share1 of $0.06 per fully diluted share for the same period in 2017.

•Working capital deficit was $12.2 million as of September 30, 2018. Cash, cash equivalents and restricted cash totaled $10.4 million as of September 30, 2018.

Mr. Hu Xiaoming, Chairman and Chief Executive Officer of Kandi, commented, “EV sales were impacted in the third quarter due to the JV Company’s new EV models awaiting MIIT’s approval to be included in the Directory of Recommended Models for Energy Saving and New Energy Vehicle Demonstration and Promotion, as well as approval of purchase tax exemption. Additionally, a large increase in the research and development expense caused a decline in net profits in the third quarter. However, we are happy to announce that the JV Company’s new EV models obtained all required approvals from MIIT for both Directory of Recommended Models for New Energy Vehicles and the Tax Exemption on September 19, 2018, and are now available for sale on the market. With the launch of the new EV models, the Company’s operations are forecasted to improve. The management team remains confident in enhancing Kandi’s brand name and competitive edge through its consumer favored EV products.”

Net Revenues and Gross Profit

Net revenues for the third quarter of 2018 increased by 34.0% compared to the same period of last year. The increase in revenue was mainly due to the increase in EV parts and off-road vehicles sales during this quarter. The selling prices of our products for the three months ended September 30, 2018 decreased on average from the same period last year. The increase in revenue was primarily due to the increase of sales volume.

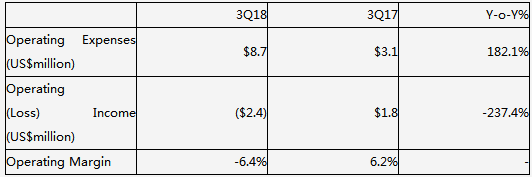

Operating Income (Loss)

Total operating expenses in the third quarter of 2018 were $8.7 million, compared with $3.1 million in the same quarter of 2017. The increase in total operating expenses was due to the increased R&D expenses, which were $5.7 million in this quarter compared with $0.7 million in the same quarter last year.

GAAP Net Income (Loss)

Net loss was $6.5 million in the third quarter of 2018, compared with net income of $1.9 million in the same quarter of 2017. The decrease of net income for this quarter was primarily attributable to the loss from the JV Company and increased R&D expenses this period as compared to the same period of last year.

Non-GAAP net loss was $5.0 million in the third quarter of 2018, compared to Non-GAAP net income of $2.9 million in the same quarter of 2017. The decrease of net income (non-GAAP) was primarily attributable to the loss from the JV Company and increased R&D expenses this period as compared to the same period of last year.

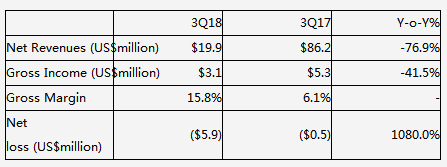

Kandi Electric Vehicles Group Co., Ltd. (the “JV Company”) Financial Results

In the third quarter of 2018, the JV Company sold 1,502 units of EV products.

The condensed financial income statements of the JV Company in the third quarter are as set forth below:

Revenue for the JV Company was $19.9 million in the third quarter of 2018, a decrease of 76.9% compared to the same quarter of 2017. Net loss was $5.9 million, a 1080.0% increase in the loss compared to the same quarter of 2017.

Kandi’s investments in the JV Company are accounted for using the equity method of accounting because Kandi has a 50% ownership interest in the JV Company. As a result, Kandi recorded 50% of the JV Company’s losses of $2.9 million for this quarter. After eliminating intra-entity profits and losses, Kandi’s share of the after-tax loss of the JV Company was $3.2 million for the third quarter of 2018.

Third Quarter 2018 Conference Call Details

The Company has scheduled a conference call and live webcast to discuss its third quarter 2018 financial results at 8:00 A.M. Eastern Time (9:00 P.M. Beijing Time) on November 9, 2018. Mr. Hu Xiaoming, Chief Executive Officer of the Company, and Mr. Mei Bing, Chief Financial Officer of the Company, will deliver prepared remarks to be followed by a question and answer session.

Dial-in details for the conference call are as follows:

• Toll-free dial-in number: +1-800-263-0877

• International dial-in number: + 1-646-828-8143

•Webcast and replay: http://public.viavid.com/index.php?id=132150

A live audio webcast of the call can also be accessed by visiting Kandi's Investor Relations page on the Company’s website at http://www.kandivehicle.com. An archive of the webcast will be available on the Company’s website following the live call.